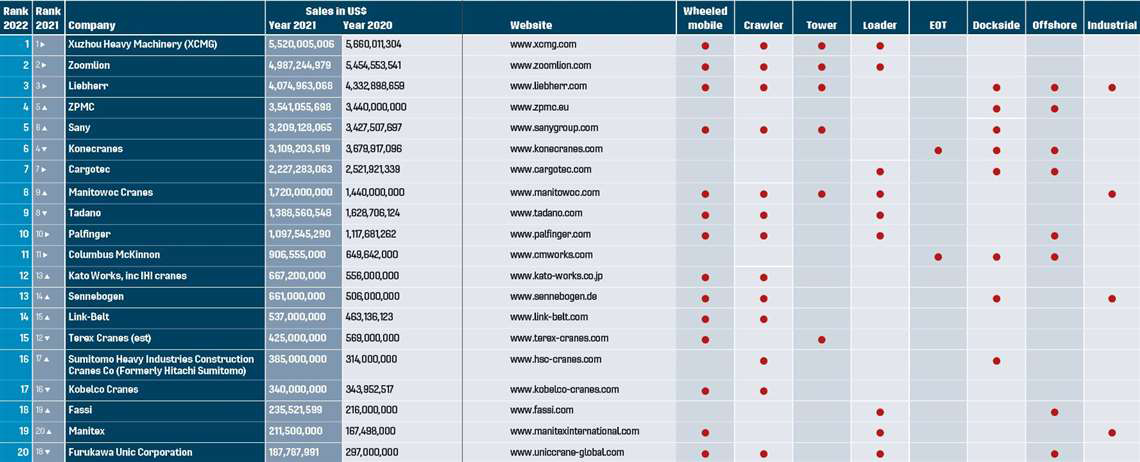

Who Are the Largest Crane Manufacturers in the World?

Ranking the world’s largest crane

manufacturers according to the value of their crane-related sales activity sounds

simple enough. Ordinarily it works out quite well as it has usually done

through the many years we have been doing the ICm20.

In last year’s table, the major upheaval

was that many companies changed places as a result of the huge surge in sales

put on by Chinese manufacturers, despite there being a global pandemic. In this

year’s table it is less about changes in position and more about exchange

rates.

Converting

the company’s sales figures from their local currencies into US dollars has

created a significantly different picture from usual due to big changes in

currency exchange rates since last year.

Primarily

this concerns the rate of exchange between the US Dollar and the Euro, the

Japanese Yen and the Chinese Yuan. Against this time last year the value of the

Dollar is 30 % up on the Yen, 19 % up on the Euro, and 14 % up on the Yuan.

This

year’s total value of the ICm20 companies’ sales in US dollars is

US$35,431,553,926, down 4 per cent from last year’s $36,944,945,662. Without

the extreme shift in the exchange rates and the high value of the dollar

contributing towards the $1.5 billion difference from one year to the next, it

would be interesting to know if there would have been an increase on last year.

While a decline in the total might be

unsurprising given the potential impact of a global pandemic, all but three of

the companies in the ranking posted increases in sales over the year before,

several of them well into double digits.

It should also be noted that one of

those three companies, Terex, has a lower figure this year as a result of

readjustment of an over estimation of the total in previous years. It doesn’t

report separate figures for its crane sales which are now all incorporated in

the Materials Processing division.

Terex is also likely to have increased

its crane sales since last year, probably across all its tower, pick and carry

and rough terrain ranges, in line with the majority of other manufacturers.

Largest crane

manufacturers of 2022

In terms of places in the ICm20

table, the top three are the same as last year,

headed by XCMG, followed by Zoomlion, both from China. Liebherr in third

increased its crane sales, in its reporting currency, by more than 11.5 %, as

did XCMG. Zoomlion’s increase was a more modest 4.6 %.

In fourth place this year China’s ZPMC

displaced fellow port and industrial crane maker Konecranes from that position.

Finland-based Konecranes was further displaced to 6th by another Chinese

manufacturing company, Sany, which gained a place in 5th with a 7 % increase in

sales.

Retaining its 7th place is Cargotec which

increased its crane sales by 4.7 %. Its Hiab loader crane division was largely

responsible for the rise.

Next

is Manitowoc, gaining one place at the expense of Tadano, down one to 9th. The

former posted an impressive 19 % increase in sales (reporting in US$) while

Tadano, also in double digits, was up 10.5 %, in its reporting currency, as

noted above, worth much less than a year ago against the dollar.

Rounding

out the top 10 is Palfinger, in the same position as last year, despite a 16.5 %

increase in sales. Also retaining the same place in 11th is industrial crane

manufacturer Columbus McKinnon, up a massive 40 % on last year.

The next three, Kato, Sennebogen and Link-Belt, all gained places in the table at the expense of Terex, as noted earlier. The Japan-, Germany- and USA-based trio all posted double digit increases in sales, Sennebogen by a spectacular 30 % over last year.

HSC gained a place at 16th with a 23 % increase in sales. Introduction of several new models is likely to have helped this Japanese manufacturer, now called Sumitomo Heavy Industries Construction Cranes Co (formerly Hitachi Sumitomo).

Increases

were reported by the parent company Sumitomo Corporation “in all of orders,

sales and operating profit as demand was recovering in Japan and the North

America region.” Operating profit in the logistics and construction segment at

JPY 19.3 billion, was 42 % up on the previous year.

Fellow

Japanese crawler crane manufacturer Kobelco, down one place at 17th, reported

its crane sales as being similar to the year before. Even though sales were

down in the USA due to an issue with regulatory compliance concerning the Hino

engines, they were up in India, Europe and other places, by way of

compensation.

This

may change in reverse for next year’s table, however, in light of the news

about a similar regulatory compliance issue now affecting some crane and

excavator models with Hino engines sold in Europe.

Loader

crane manufacturer Fassi from Italy, in 18th, gained a place from last year, on

the back of a 28 % rise in sales, from €189 million to €242 million. To

illustrate the exchange rate difference mentioned earlier the increase on the

dollar conversion figures from this year and last is just 9.25 %.

Next

in the table is Manitex with a 26 % increase in sales. The USA-based

manufacturer of boom trucks also makes loader cranes (PM) and industrial yard

cranes (Valla) in Italy.

In

20th place this year Furukawa has dropped from 18th losing out to the big

increases at Manitex and Fassi, plus its sales were down by JPY4 billion.