UK's Top 100 Construction Contractors 2022

Steve Menary takes a deep dive into the

financial performance of the UK’s 100 leading construction contractors.

The construction industry’s leading

companies are bouncing back from the worst of the Covid-19 pandemic and the

shock of Brexit; turnover and profits are improving – but challenges remain.

The Construction Index’s latest Top 100

shows leading construction contractors altogether earned £70.4bn in revenue,

according to accounts available at Companies House as of the end of July 2022.

This was an increase of just 3.2% on the previous year’s results for the same

companies.

But turnover has increased at 62 of the Top

100 and there has been a massive upswing in terms of profitability.

Only 14 firms in the Top 100 registered a

loss in their latest accounts. For many of those business, which include Tarmac

Trading, Mace, NG Bailey and McLaren, the most recent figures available at Companies

House for were for 2020, when the pandemic was wreaking the most financial

damage.

As a result, a combined profit for the Top

100 could have been even greater than the £1,404m we see here. This aggregate

profit was a huge improvement on the previous trading year, when the same 100

companies posted an aggregate loss of £43m.

The reason for the huge swing is that the

majority of the annual results posted here are compared to a previous

accounting period that was caught up in the eye of the pandemic. Companies

including Kier, Amey and Multiplex posted huge deficits in their previous

year’s trading and that dragged the overall figure into the red.

Taking away the losses posted by those

three companies, the rest of the Top 100 generated profits of £450m in the

previous year. That is perhaps a better illustration of the rebound in the

industry’s fortunes.

Earnings are improving and profit warnings

from companies listed on the UK stock market are at record low levels. A spread

of work is allowing larger companies to rebuild their balance sheets but only

one contracting family, the Kirklands (owners of Bowmer & Kirkland, which

is ranked 16 on turnover in the latest TCI Top 100) still features on the

latest Sunday Times’ Rich List.

The industry does remain a major part of

the UK economy and the Top 100 employ more than 219,000 people directly, but

while the majority of leading contractors have recovered there have still been

casualties.

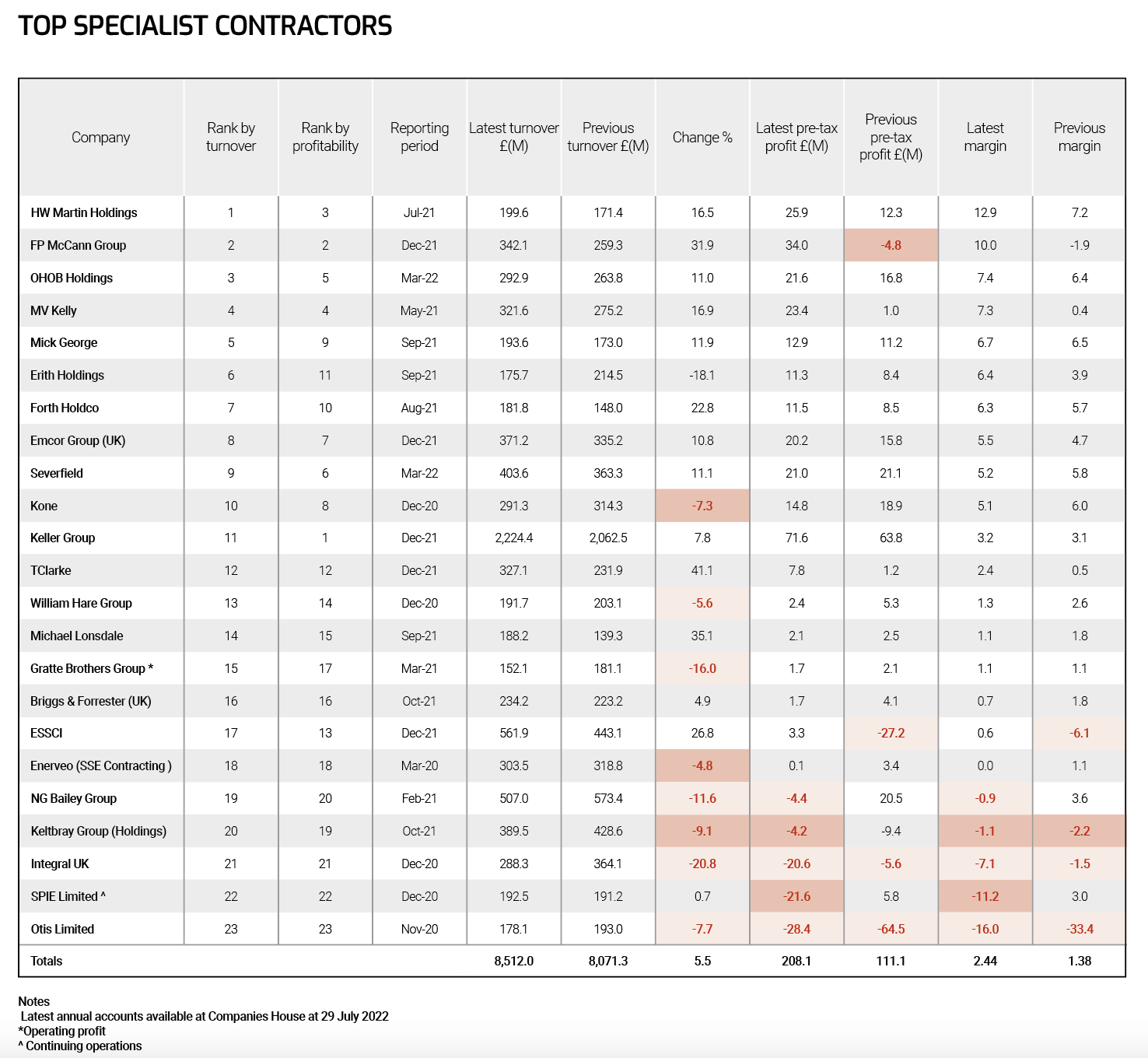

Over the past year, NMCN and Midas – ranked

41 and 62 respectively in last year’s Top 100 – both collapsed and insolvencies

started to rise significantly at the start of 2022 as government support and

credit forbearance dissipated. The collapse of even a mid-sized main contractor

inevitably gains more media coverage but it is the specialist contractors who

are bearing the brunt of tighter conditions.

In the first six months of this year, the

number of construction companies becoming insolvent doubled to 2,082. More than

half (1,082) of these corporate failures were specialist contractors. The number

of specialist contractors being liquidated has also more than tripled over that

same time period.

An added pressure began in March 2022, when

the first repayments were due to be made on loans made through the Coronavirus

Business Interruption Loan Scheme. CBILS closed to new applications at the end

of March 2021and businesses were given 12 months before starting to make

repayments on loans of up to £5m over six years. The early signs for

construction are not good.