Off-highway Machinery Market Experiences Strong Growth in 2022

By Saul Wordsworth

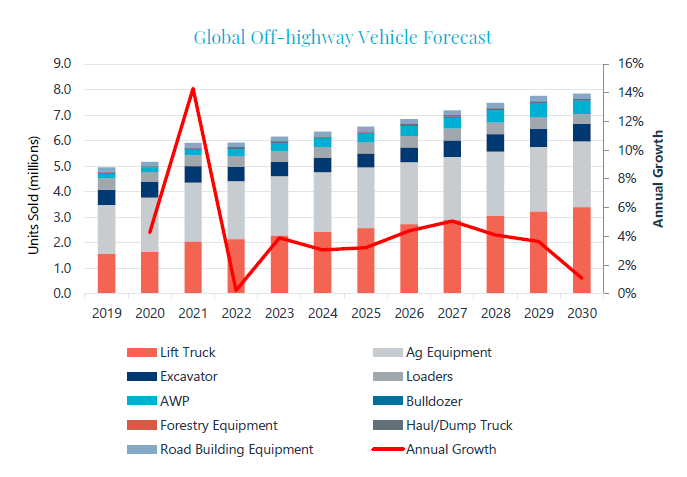

As the world emerges from the

aftermath of the Covid-19 pandemic, updated research by Interact Analysis

reveals that the off-highway vehicle market has experienced strong growth. In

part, this has been driven by a pandemic ‘bounce-back’. However, a huge uptake

in electrified forklifts and material handling equipment, and a strong

construction industry are also fueling growth. Despite this, global events such

as the Ukraine-Russia conflict and ongoing supply chain disruptions are

expected to have a continuing impact on the off-highway vehicle market. In

particular, the Chinese off-highway machinery market suffered a difficult year

in 2022.

In the long term, market growth for the off-highway vehicle

sector looks set to remain positive due to strong investment in warehousing

solutions, India’s pledge to mechanize agriculture and the US’s investment in

infrastructure. In the short term, the extended lockdown period in China has

had an unprecedented downward impact on market growth within the APAC region,

while ongoing freight delays and component shortages have impacted the ability

of manufacturers to meet demand. In 2022, OEMs experienced very strong order

intakes, but due to supply chain disruption were unable to fully meet market

demand, restricting growth.

The Chinese market performed worse than

Interact Analysis forecast back in 2021 due to the country’s strict covid

policies. Nevertheless, as the country represents the largest market for

off-highway machinery it is expected to bounce back well in the coming years.

This has led Interact Analysis to be more bullish with their forecasts for

global electrification.

Electrification – and other

alternative fuels – within the off-highway market is now well established.

Almost all machine manufacturers have at least one – often several – battery

electric or hydrogen models available to purchase or in the pipeline. Although

hydrogen powertrains are becoming established in some material handling

applications and in larger equipment, it is battery electric powertrains that

are forecast to dominate in the long term when it comes to alternative powertrains.

“It’s

promising to see that even some of the larger machinery types such as

excavators and haul trucks are being electrified,” said Alastair Hayfield,

senior research director at Interact Analysis. “Smaller machinery

electrification has paved the way for this, enabling OEMs to experiment before

moving on to larger, more complex machinery. Interact Analysis is more

bullish on the demand for electric machinery versus its previous research. In

years to come we can expect to see huge developments made toward

electrification within the compact machinery market, particularly in Western

Europe and China. The Netherlands, for example, is showing very positive signs

for off-highway machinery electrification with an uptick in government funding

and city bans on polluting vehicles driving this.”