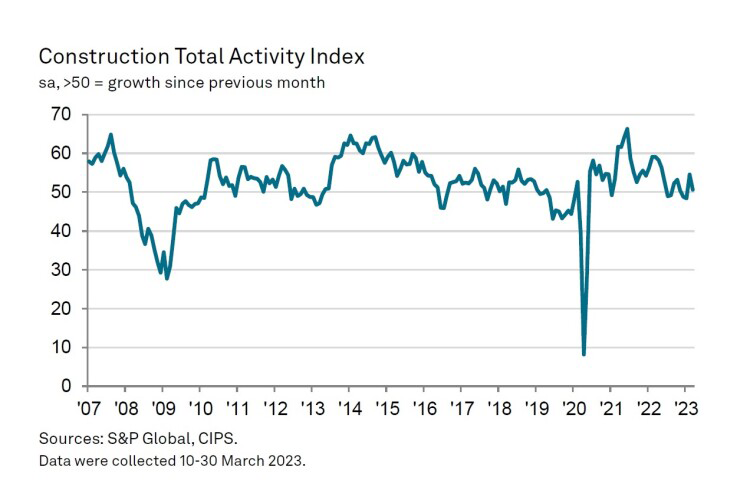

House-building Slowdown Drags Construction back towards Stagnation

The UK construction industry saw marginal

growth in total output in March, with the seasonally adjusted S&P Global /

CIPS UK Construction Purchasing Managers’ Index (PMI) indicating a score of

50.7. Although this marks an increase, it was lower than the 54.6 registered in

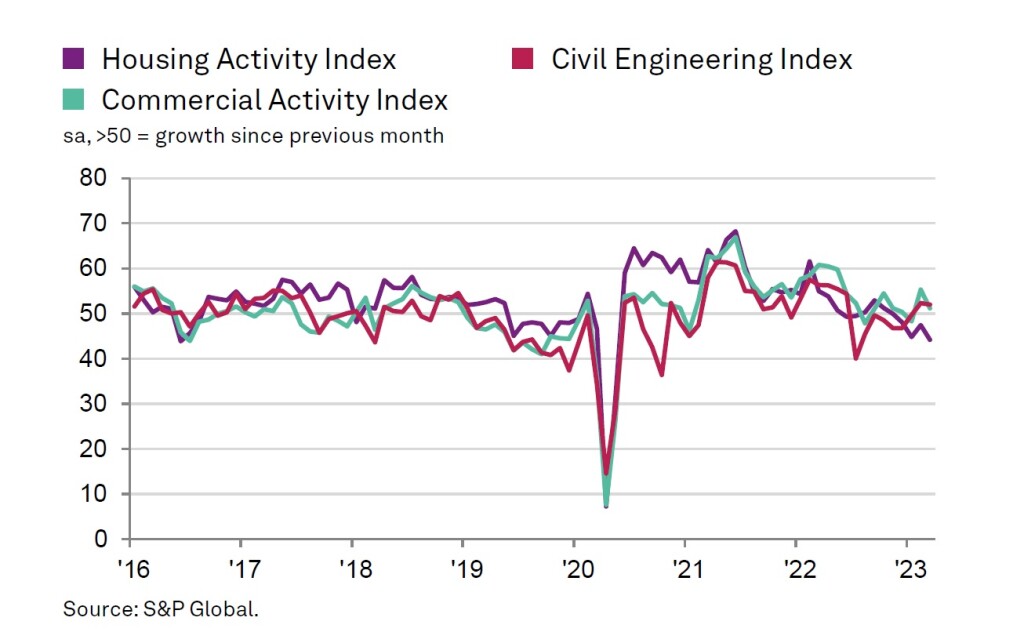

February and indicates a slowdown in growth. Civil engineering (52.0) was the

fastest-growing area, thanks to demand for transport-related construction and

work on HS2 projects. Commercial building (51.1) also saw an increase, although

at a slower pace than the previous month. However, housing activity (44.2)

declined sharply for the fourth consecutive month. Respondents to the survey

cited higher borrowing costs and reduced tender opportunities as reasons for

this trend.

Construction companies continued to receive

new work in March, with the second-fastest rate of increase since July 2022. As

a result, the industry has accelerated its hiring pace, with a rate of job

creation not seen since October 2021. Despite this growth, some firms struggled

to find candidates, leading to wage pressures and hiring constraints.

Input prices rose significantly in March,

with suppliers attributing this to rising energy costs and wages. However, the

rate of inflation was the second-slowest since November 2020. Looking ahead,

46% of the survey panel predicted an increase in business activity in the next

year, while only 11% expected a reduction. This positive sentiment marks the

highest degree since February 2022.

According to Tim Moore, economics director

at S&P Global Market Intelligence, the decline in house building was the

main concern in March. However, growth projections remain upbeat for the

construction industry as a whole, thanks to improved availability of

construction inputs and the expectation of purchasing price inflation

moderating in the coming months. John Glen, chief economist at the Chartered

Institute of Procurement & Supply, noted that the sector was heading in the

right direction, with some uplifting surprises. However, concerns over

inflationary pressures and affordability rates remain obstacles to wider

expansion.