Construction Equipment Rental Market Worth $105.29 Billion by 2030: Grand View Research, Inc

The global

construction equipment rental market size is expected to reach USD 105.29

billion by 2030, registering a CAGR of 4.2% during the forecast period according

to a new report by Grand View Research, Inc. Rising government investment in

the infrastructure sector and increasing Foreign Direct Investment (FDI) in the

construction domain to develop roads, highways, expressways, bridges,

skyscrapers, and smart cities have created a demand for rental construction

equipment. Constant technology advancement to produce cutting-edge

project-oriented construction equipment that optimizes the overall construction

process is propelling the growth of the construction equipment rental market.

Key Insights & Findings from the

report:

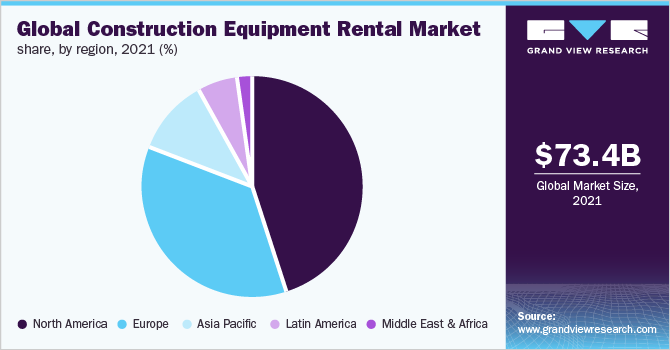

- The global market was valued at USD 73.44 billion in 2021 and is expected to exhibit a CAGR of 3.9% from 2022 to 2030.

- The earthmoving machinery segment dominated the

market in 2021 and is expected to generate a market revenue of

over USD 54.01 billion by the end of the forecast period. The

increasing application of earthmoving excavators for mining, agriculture,

and construction industries significantly contributes to segmental growth.

- Asia Pacific is expected to witness significant

growth in construction equipment rental by 2030, owing to governments'

investment in the development of the highway, airports, dams, and special

economic zones(SEZs).

- The construction equipment rental is witnessing high

competition across the globe. Major players are inclining towards

enhancing the business and product offering through strategic business

acquisition. For instance, in April 2021, United Rental Inc., a

global equipment rental company announced the acquisition of General

Finance Corporation, a specialty rental service company. United Rental

Inc. acquired complete assets of General Finance Corporation which helped

the company to enhance its product portfolio.

Construction Equipment Rental Market Growth & Trends

Higher total cost ownership of new construction equipment &

machines encourages small & medium scale construction companies and

contractors to adopt rental construction equipment. Additionally, renting

reduces the maintenance, repair, insurance, and warehousing costs associated

with owning; thus, construction equipment rental provides an economical

alternative to the construction firms.

The pandemic led to a global lockdown and supply chain

disruption which impacted the manufacturing, construction, and mining sectors

at large. Post pandemic, issues such as lack of availability of skilled

workforce, spiking raw material prices, and high EMIs have amplified

uncertainties in the construction sector subsequently hampering the growth

pace. Thus, to avoid the risk aversion and reduce uncertainty, larger-scale

construction companies are switching towards renting the construction

equipment's, thereby driving the growth of the construction rental equipment

market.

The Asia Pacific region

is expected to witness a high pace of growth during the forecast period. The

prominent players in the construction equipment rental market, based in China, are focusing on developing advanced equipment

that reduces machine downtime, requires lesser fuel, and provides high output.

Besides, the Indian government is heavily investing in massive infrastructural

projects to boost the country's economy; thus, these factors are expected to

leverage the growth of the construction equipment market in the region.