Construction Equipment Rental Market Outlook - 2027

The global construction equipment rental market size was valued at

$90,997.4 million in 2019, and is expected to reach $106,422.0 million by 2027,

registering a CAGR of 4.2% from 2020 to 2027. The construction equipment rental

is the service to rent out construction equipment to end users for a certain

period of time by signing contracts with terms and condition about their usage.

Construction equipment are majorly used at construction mining sites to

facilitate heavy operations.

The construction & mining activities

either declined rapidly or came to complete halt, which directly hampered the

rental revenues from the construction equipment.

Construction equipment rental market growth is driven by increase in

construction & mining activities in developing nations of Latin America and

Africa regions. In addition, additional expenses incurred due to maintenance of

the equipment, excessive operational cost, and high wages of skilled operators

can be saved by renting equipment for the required time, which significantly

contributes toward the growth of the global market. Moreover, high initial

investment required to buy equipment and financial constraints can be avoided

by opting for the rental equipment, thereby augmenting the market growth.

However, dearth of skilled labors is a major factor restraining

the growth of the global market. Moreover, saturation in construction and

mining industry in developed nations is another factor that hampers the growth

of the market. Furthermore, lockdown implemented due to the outbreak of

COVID-19 has led to either decline in construction activities or have come to a

complete halt. This led to cancellation of equipment contracts by end users

with rental companies, thereby declining the business during the lockdown

period. However, reopening of construction sites and introduction of vaccines

for COVID-19 are anticipated to lead to re-initiation of construction equipment

rental market companies and construction industry at their full-scale

capacities.

On the contrary, manufacturers are developing advanced

equipment, which can be operated by connecting them through internet. Moreover,

integration of IoT will help to overcome the shortage of skilled labors and

enhanced safety of operators and end users. These factors are anticipated to

offer remunerative opportunities for the expansion of the global market during

the forecast period.

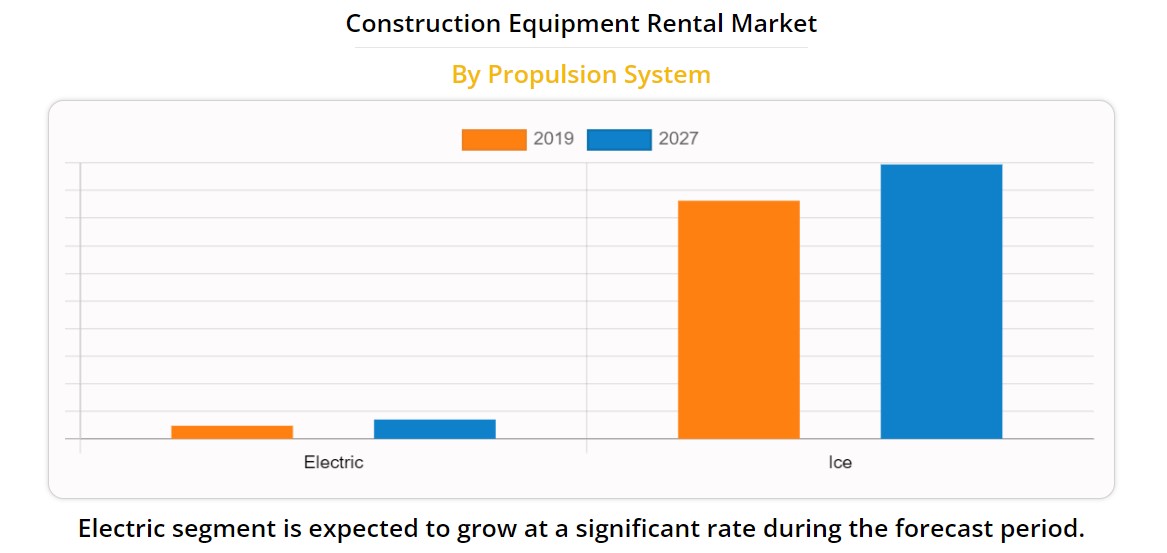

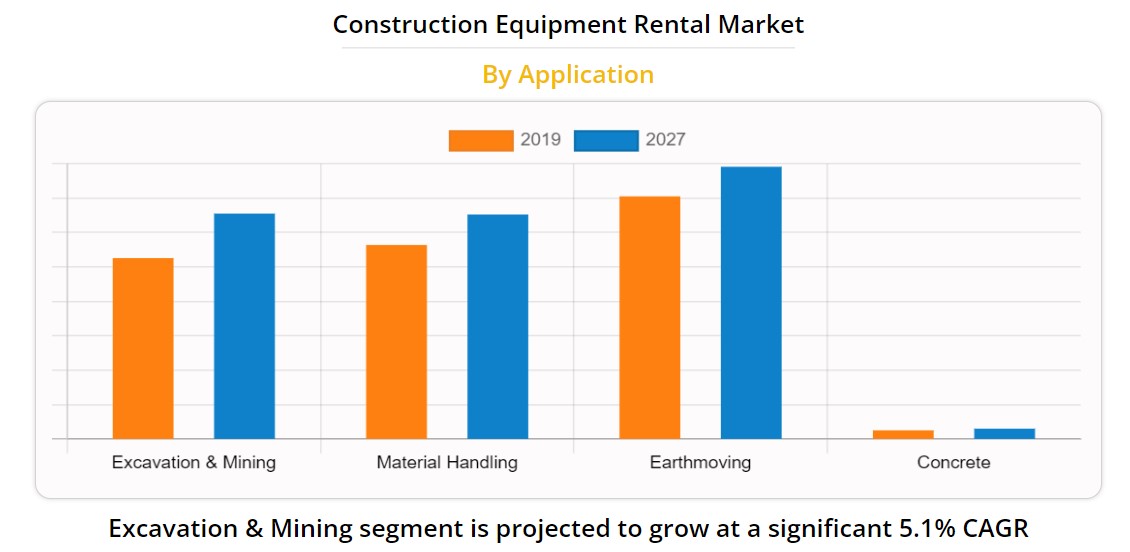

The global construction equipment rental

market is segmented into application, product, propulsion

system, and region. The applications covered in the study include excavation

& mining, material handling, earthmoving, and concrete. On the basis of

product, is the market is divided into backhoes & excavators, loaders,

crawler dozers, cranes, forklift, and others. By propulsion type, it is differentiated

into electric and ICE. Region wise, the market is analyzed across North

America, Europe, Asia-Pacific, and LAMEA.

Depending on application, in 2019, the earthmoving segment

dominated the market, in terms of revenue; however, the excavation & mining

segment is expected to witness growth at the highest CAGR during the forecast

period. On the basis of product, the loaders segment led the market in 2019, in

terms of revenue, while the others segment is anticipated to register the

highest CAGR during the forecast period. By propulsion system, the ICE segment

registered the highest growth in 2019, in terms of revenue, however, the

electric segment is anticipated to exhibit the highest CAGR during the forecast

period. Region wise, in 2019, North America garnered the largest construction

equipment rental market share, while Asia-Pacific is anticipated to secure a

leading position during the forecast period.