Construction Embracing Autonomous Tech, but Disconnects Exist

Construction firms have adopted autonomous technology to address

business challenges, with 84% of technology decision-makers in general

contracting firms adopting some form of autonomous technology in the past year.

However, a disconnect in the industry's understanding of the technology, its

application, and benefits will hinder optimization if not addressed.

The industry is looking at autonomous technology as one of the most

promising solutions to mitigate challenges like supply chain,

productivity/efficiency, and labor shortages. The study shows that construction

firms are turning to technology to help mitigate and manage challenges, many of

which have been exacerbated by the economic instability of the past few years.

Respondents cited operational issues including supply chain,

productivity/efficiency, and labor shortages as the most pressing challenges

near-term, while driving new business/growth and managing ESG regulations and

programs were ranked as top concerns over the next three to five years. More

than 80% of global respondents stated that their top three challenges represent

a “moderate to significant” bottom-line impact on their

business.

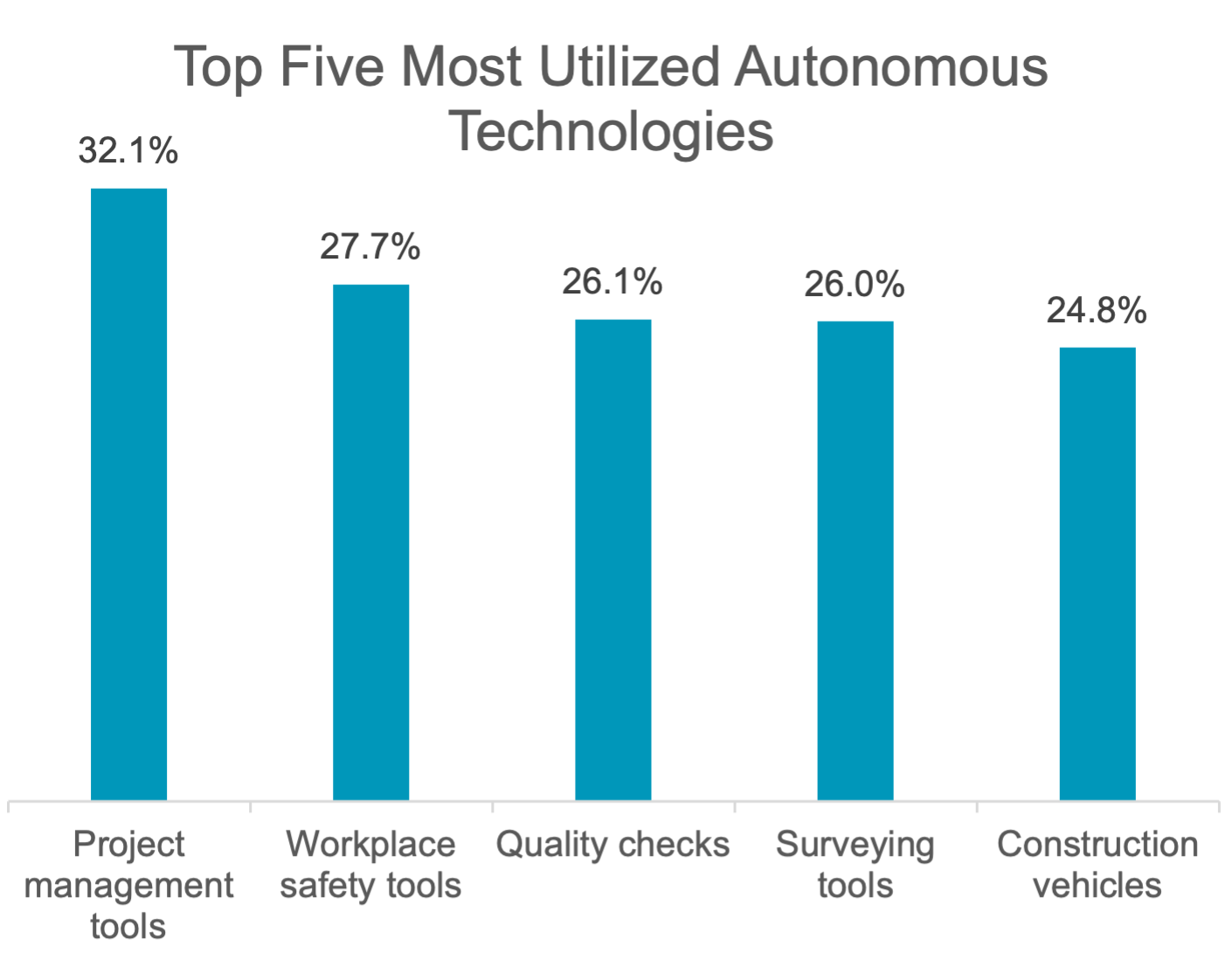

Among the autonomous technologies used, almost half are partially or

conditionally autonomous. Project management was cited as the most popular

application (32%) followed closely by workplace safety (28%), quality control

(26%), surveying (26%) and vehicle operation, document management and verification/project

inspection (all at 25%). However, firms appear to have trouble identifying the

best autonomous or automated technology to solve their specific challenges and

pain points. For instance, among survey respondents who stated that improving

supply chain management is a top priority, only 28% reported an investment in

autonomous monitoring technology, one of the top reported technologies that aid

in this area.

Additionally, 37% of respondents cited fully autonomous robotics to

drive sustainability benefits as a leading priority in the next 3 to 5 years,

yet only 17% are investing in this type of technology. This, says the company,

indicates that while construction firms are reporting clear benefits across key

business areas, their use of autonomous solutions is not always aligned to

their most pressing challenges.

Autonomous technology can make job sites safer and more efficient

while managing the gap between data created from a project and the data

actually used to find meaningful insights and generate opportunities. Thomas

Harring, president of Hexagon’s Geosystems division, stated that

"Construction firms are turning to autonomous solutions to mitigate risks

better and improve the effectiveness of operations, which are both key to

overcoming the productivity, sustainability and profitability issues they face

every day."

Harring explained that these digital solutions can be leveraged to

make jobsites safer and more efficient while accelerating innovation and

maintaining business resiliency. He believes that "the firms that will

redefine this industry are no longer defining themselves as construction

companies but rather as hybrid companies with technology, engineering and

construction at their core — and autonomous technology will play a major role

in this evolution."