Demand for Earthmoving and Material Handling Equipment in Germany is Set to Increase

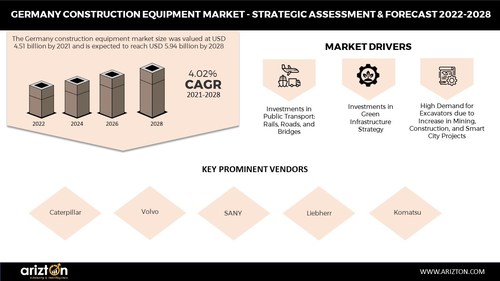

According to Arizton's latest research

report, Germany construction equipment market will grow at a CAGR of 4.02%

during 2021-2028. The country's new government under the 'Federal Ministry for

Housing, Urban Development and Building in 2022 has aimed to expand housing

construction. It has planned to build 400,000 apartments every year. Under the

Housebuilding subsector, investments grew by 39% in 2021, where the number of

new flats and houses coming to the market doubled to more than 300,000 units.

Such initiatives by the government give a significant boost to the Germany

construction equipment market.

Market Size and Forecast is projected in:

Value ($ Billion)- USD 5.94 Billion

Volume (Units)- 101,807 Units

The Germany Rail (Deutsche Bahn) and the

federal government have targeted to spend USD 13.56 billion in 2022, which is a

6.3% increase compared to 2021. This investment by the government majorly

focuses on renewing and modernizing Germany's rail infrastructure. The country

has planned to mend bridges on much of the country's Autobahn network. A budget

of USD 529.17 million has been set by the German Government's Road firm,

Autobahn, in 2022.

In addition, the German government allotted

USD 372.42 million for road construction projects in 2022 in the Brandenburg

region, which is approximately USD 5 million higher than in 2021, which will

significantly contribute to the Germany construction equipment market growth.

The Earthmoving Segment Accounted for the

Largest Share

In 2021, the earthmoving segment accounted

for a share of 56.5% of the Germany construction equipment market. Excavators

accounted for the largest market share of 54.3% of the earthmoving segment.

Germany's National Development Plan 2030

has increased the number of civil engineering and housing projects in 2021,

which, in turn, is expected to support the demand for excavators in Germany.

High Demand for Excavators Due to Mining,

Construction, and Smart City Projects

Regardless of the Covid-19 impact,

investment opportunities in the construction industry have attracted foreign

investors who have aided the construction equipment market in 2021. The

government's aid in the residential projects, rise in infrastructure

construction, increase in FDI and surge in the rental investment of

construction equipment is expected to lead the Germany construction equipment

market.

The growing demand for excavators is

attributable to the improvements in the mining and construction sectors and a

few government projects like the smart city project. The smart city project is

supported by the government's investment of USD 751.42 million. The mining

industry consumes a large part of the excavator industry in Germany. Hard coal

and lignite make up most of the mineral resources extracted in the country.

Investment in Green Infrastructure Strategy

The country has targeted investing USD 220

billion by 2026 to support the industrial transformation, including climate

protection, hydrogen technology, and electric vehicle charging station

expansion. The construction machinery and building experienced a 22% increase

from the previous year (2020) due to the infrastructure push with highways,

dams, and green cities, which require tons of heavy machinery; such activities

are contributing to the Germany construction equipment market.